Back Into Bondage

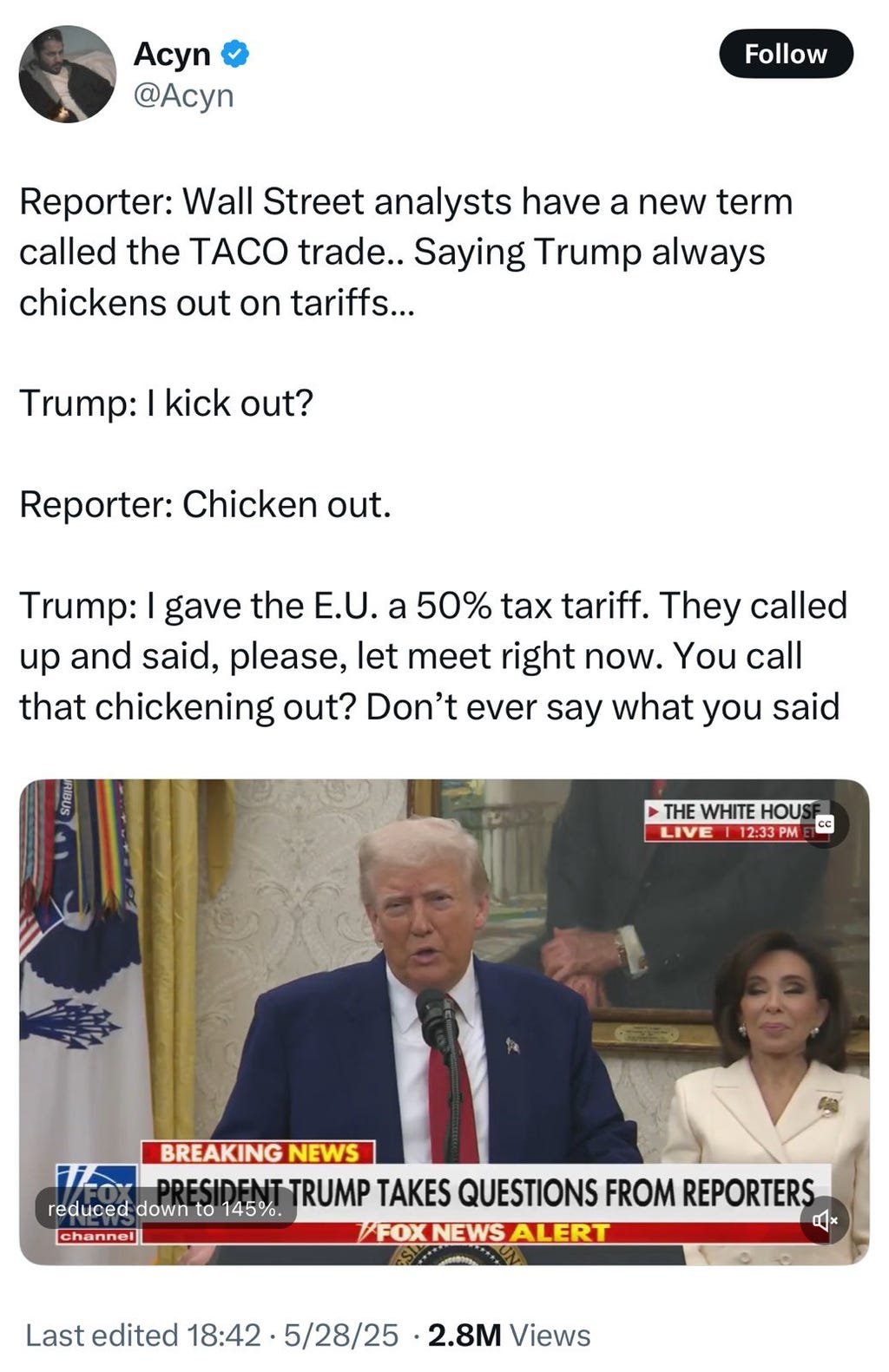

Shortly after Trump backed down on the China tariffs, he attempted to maintain the mirage of remaining King Tariff Man by announcing 50% tariffs on the EU. However, the markets were not buying it, as the popular theme in financial circles had transformed into the Trump “TACO” trade - Trump Always Chickens Out. Unfortunately for markets, a reporter was silly enough to point this out to Trump during a White House press conference.

As you can imagine, this was disconcerting for someone with the psychological makeup of a red-haired fifth-grade bully. Predictably, Trump responded by making a series of announcements in the vain attempt to appear tough: ordering US chip designers to stop selling to China, going back to 50% tariffs on steel and suddenly informing the world that China had violated its agreement with the US.

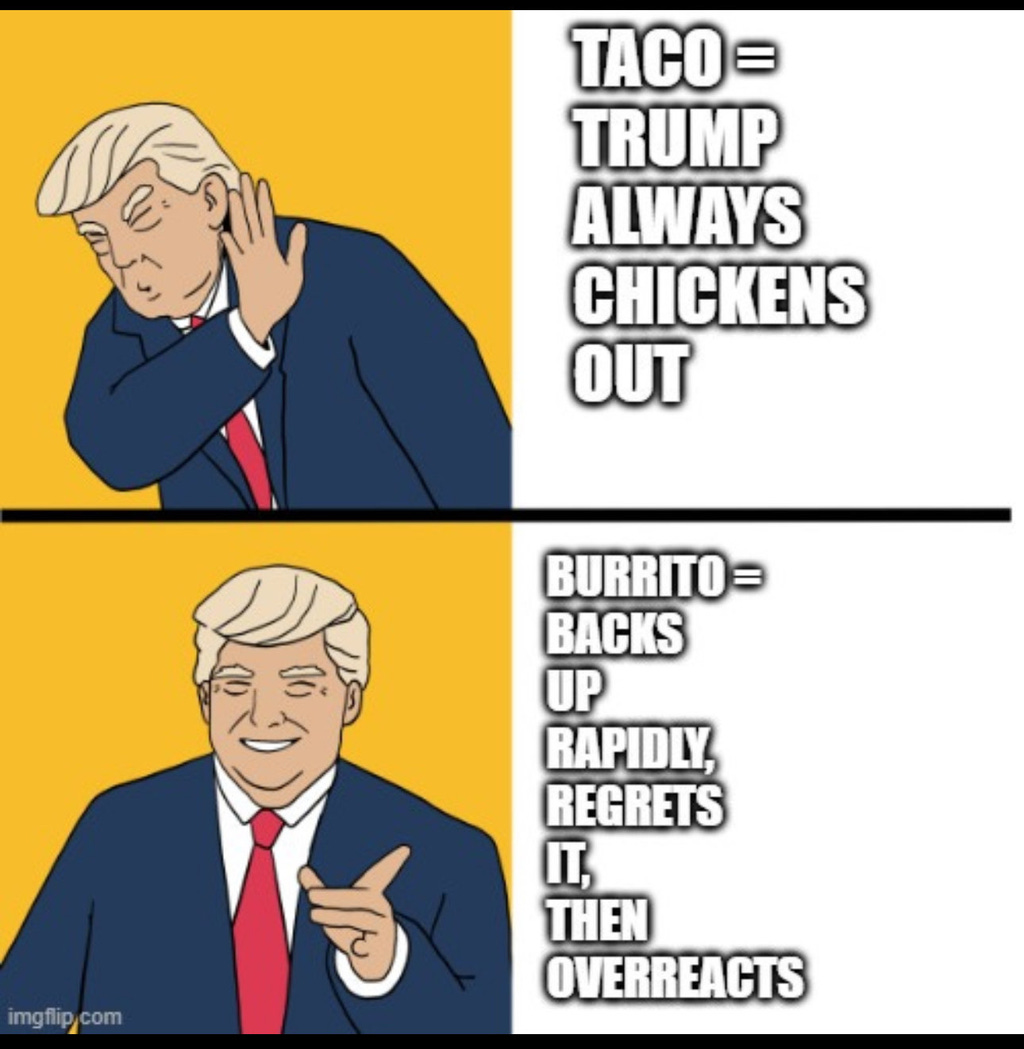

BuccoCapital Bloke summed it up best with the following tweet:

Now we have entered into a new market regime, the Trump “BURRITO” trade - Backs Up Rapidly, Regrets It, Then Overreacts.

As ridiculous as this headline driven market is, what we are actually witnessing is a battle over the US Constitution - Trump´s attempt to govern by fake emergency executive orders versus the constitutional requirement to go through congress for most of what he has attempted to do in his first half-year in office. This is not a drill.

Then news broke that a US federal court had blocked Trump´s "Liberation Day" tariffs from going into effect. One can assume this might be particularly amusing for China.

The reality TV extravaganza continued when the federal court issued a stay order. Meaning, the Trump tariffs would actually remain in place, likely awaiting a higher court ruling. Translation: this will be decided by the Supreme Court. The odds do not look good for Trump with the Supreme Court given their federalist tilt. In the meantime, markets grind higher.

A Masterful Grift

Crime season has not abated whatsoever for the Trump family, as they accepted 2 billion USD from Saudi in exchange for a stablecoin they minted out of thin air that they are running through Binance. Curiously, the SEC dropped the remaining aspects of its lawsuit against Binance at the same time.

Trump Media also announced a 2.5 billion USD Bitcoin treasury deal. Meaning, they plan to raise 2.5 billion USD in debt to buy Bitcoin to put on their balance sheet. Many companies are now mimicking the Michael Saylor Strategy playbook. This is likely where we see large problems during the next bear market.

We then had the pleasure of witnessing two Billionaire Bros with daddy issues begin the disintegration of their viral bromance. DOGE had gone from promising to cut 2 trillion USD in yearly spending to cutting approximately zero USD in government spending, representing one of the largest failures in US political history. This was too much negative press to handle for Chainsaw Ketamine Man, so he took to X to express his displeasure with the newly proposed government spending bill, which will add at least 2.5 trillion USD of more debt to the US deficit.

This was not a surprise to us, as our base case has been that DOGE was nothing but a distraction that would not cut spending and that the tariffs were much of the same, destined to be blocked by the US judicial system (decent predictions as of today). Displaying classic sociopathic tendencies of having no shame at all, Trump started campaigning to permanently eliminate the debt limit. I bet you did not see that one coming... from trillions in austerity budget cuts to trillions in additional deficits in the blink of an eye!

While Lyn Alden is to credit for the modern meme of NOTHING STOPS THIS TRAIN, Alexis de Tocqueville was the OG meme lord concerning the US democratic system. 1835 throwback y’all.

We are in the part of the cycle where all roads lead to the money printer. Even countries like Germany have eliminated their debt break, capitulating to our inevitable brrrrrrrr forever future.

As Trump cannot convince Jay Powell, head of the Federal Reserve, to cut rates, he has moved on to the next logical move... telegraphing to markets that Powell’s successor will be announced soon, a man who will no doubt be put in place to provide the rates cuts that Trump so desires.

We are so bearish, we are bullish

Markets seem to be getting desensitized to Trump´s antics, which we see as being bullish. In April, we were panic selling news headlines that now have people generally shrugging their shoulders in disinterest. Furthermore, we have seen a 180 pivot from austerity to further blowing out the deficits on a forever timeline. When the market fully stops reacting to all negative catalysts and when the spending bill gets officially approved, that would be the time to buckle up and lock-in for the next stage of this Ponzi scheme.

Set and setting were becoming too obvious for us, so we bought more gold and bitcoin. Gold is trading at 3307 USD per ounce, and Bitcoin has retraced from all-time-highs, trading around 105k, but still had its highest monthly close ever.

We leave you with a quote from Alexander Fraser Tytler: