Gnarly 180s

Written by Paco Dinero with editorial contributions from Andrej Berlin

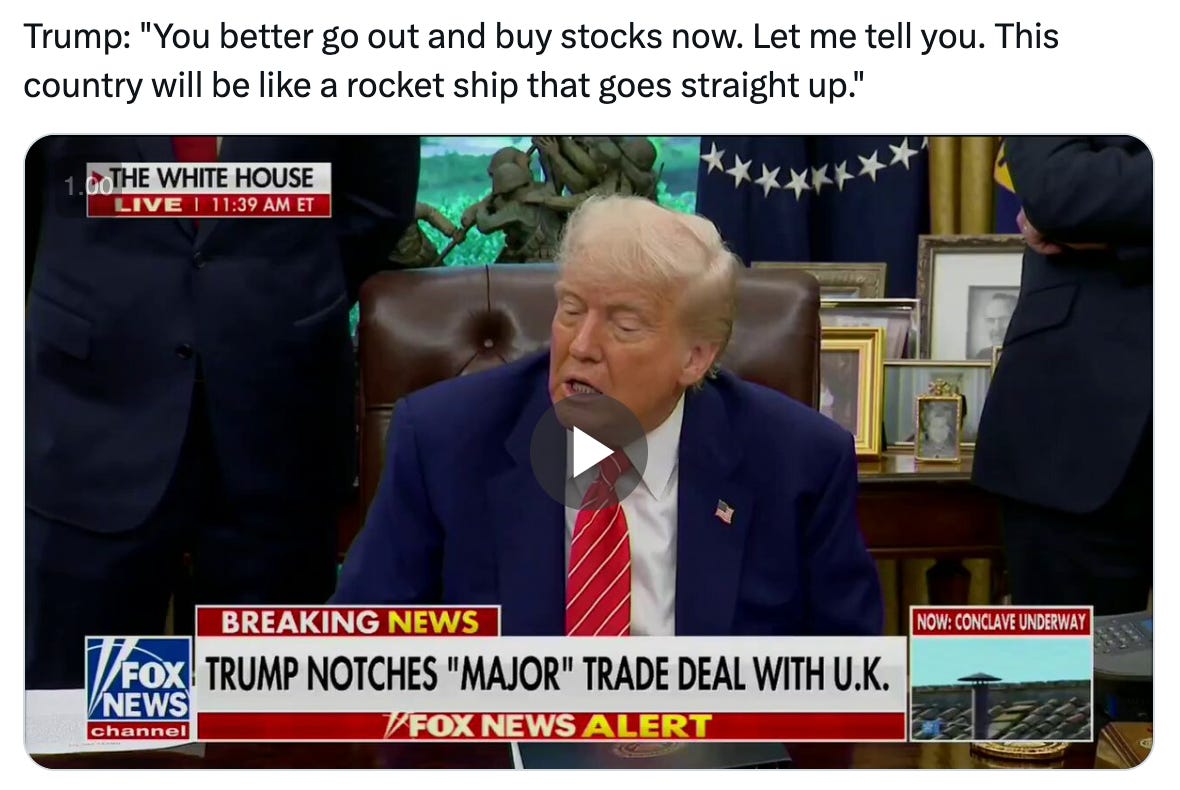

Market manipulation continues

Who would blink first in the "trade war", China or the USA?

The US announced last week that it would cut tariffs on Chinese goods to 30% from 145% for 90 days. In turn, China announced that it would lower tariffs on US goods to 10% from 125% for 90 days. Just prior to this announcement, we got another full caps post from Trump: YOU BETTER GO OUT AND BUY STOCKS NOW.

Just a friendly reminder that we now not only live in a world where foreign powers can directly transfer money to the Trump family through Trump coin but also one where the POTUS posts investment tips prior to large geopolitical announcements.

Price controls in the disguise of an “Emergency“

It is important to remember that Trump has been issuing his Executive Orders through the use of the IEEPA:

The International Emergency Economic Powers Act (IEEPA) is a U.S. federal law enacted in 1977 that grants the President authority to regulate international commerce in response to an “unusual and extraordinary threat” to the nation’s security, foreign policy, or economy, originating in whole or substantial part outside the United States.

All China had to do was say it was rooting out all Chinese links to enabling fentanyl fabrication and shipment into the US, and Trump´s IEEPA would look unconstitutional when challenged in court. China moved this piece into place on the chessboard, and voila, Trump found himself playing checkers alone in the Oval Office.

As if things were not moving fast enough, Trump simultaneously announced that he would be signing an executive order reducing prescription drug and pharmaceutical prices by "30% to 80%". Price controls. Lowering the cost of Big Pharma and Big Med inflates down the real cost of social security services for the elderly during a time when US government deficits are exploding.

If drug and medicine costs are forced down, US government outlays for the elderly are perpetually reduced.

DOGE results in approximately zero cuts to government spending

A primary goal of this administration from day 1 was to attempt to fix large fiscal and trade deficits by any means necessary (inflate down the real value of the US government debt). If we have learned anything so far this year, it might be that such issues cannot be solved preemptively by government policy.

Please recall that Elon Musk and DOGE were going to cut up to two trillion USD in yearly government spending, which would have represented the austerity side of reducing large fiscal deficits (also would have caused a great depression and lowered tax receipts, but let’s not get sidetracked here). After “cutting” less than 150 billion USD in spending - money that will not actually be cut but rather shift from soft power agencies like USAID to hard power agencies like the Pentagon (Golden Dome, Baby!!!)- suddenly Musk finds himself ousted from Washington to once again pump the price of Tesla stock and continue enjoying those large government defense contracts (DOGE did not cut any of his contracts).

Meanwhile, Trump is proposing deregulation of banks (read: QE), tax cuts, and the budget they are proposing to Congress seeks to add an additional six trillion USD in debt to the ongoing US deficit. As Lyn Alden likes to say...

Tariffs shifting to consumers

Walmart announced that it would be forced to push through price hikes for its products, given what tariffs had done to import costs. Trump unleashed a king tirade that essentially told Walmart to just eat the cost of the tariffs rather than maintaining its thin profit margins of 3% - 4%. In the blink of an eye, we went from the WONDERFUL tariffs that will be paid for by foreign companies, which will safeguard the US consumer from the prices rising part of the cycle, to the JUST EAT THE TARIFFS WALMART part of the cycle.

If you were under any delusions that Trump understands even the basics of trade deficits, these interactions should dispel you of such myths.

Chaotic reality TV tariff headlines persist

Likely in an attempt to deflect attention from China having called his bluff and informing US companies that they would be expected to dine on tariffs, Trump then announced a 50% tariff on all goods from the EU, starting on June 1, 2025.

It is very hard to take him seriously at this point as the Trump admin has done a full 180 since taking office 124 days ago, from fiscal restraint and massive DOGE cost cutting, to most recently announcing that outgrowing the debt by increasing GDP was the only way out of their dilemma (read: inflating away the debt as quickly as possible). Recently ousted Musk even chimed in to reiterate the party line.

Although Scott Bessent started his term by telling the public that it was “Main Street’s” time and that Wall Street would have to take a back seat to the population at large during deficit and cost reductions ahead, he was recently sent on media rounds to elaborate on the 180 policy change.

He looks constipated because it is hard to pass stool when you are full of shit and lying through your clenched teeth. The republican party has been trying to sell the grow our way out of debt nonsense for decades. Unfortunately, the odds of growing the economy faster than the debt, given populist desires and deficit levels, are similar to the odds of a golden dome missile defence system being useful in the USA in the year 2025 (gotta throw some bones to those military-industrial defense complex overlords). The 30-year yield is currently threatening October 2023 highs. Instead of posting another nothing stops this train meme, we provide you with an image of a hamster furiously running on a wheel.

Amidst these policy shifts, BTC hit a new all-time high. Unironically, Trump posted the following.

BTC has currently retraced a bit from all-time highs and is trading around 107k. Gold is trading at 3356 USD per ounce. Meanwhile, the fiat in our pockets is turning into confetti.

Until next time...