Part 2: What is actually happening in web3?

Written by Andrej Berlin with editorial contributions from Savannah Lee.

Before going into the current state of the web3 and crypto industry, let’s review what “web3” is:

web0 (pre-internet)

Newspapers are printed and distributed, physical paintings owned by artists, banks own money, institutional trust is established by ink-based stamps on documents.

web1 (1990s–early 2000s)

Institutions publish online magazines, companies can distribute content they choose, own, and profit from.

web2 (mid-2000s to present)

Individuals publish content (text, images, videos, games) and receive credit, but companies retain legal ownership and control of platforms.

web3 (emerging)

Individuals own their money, digital assets, and data, deciding how to share it. Blockchain-based smart contracts, decentralized technologies, and digital signatures establish trust without intermediaries.

Web3 encapsulates a set of behaviors required to maintain a social fabric where each individual is fully autonomous and part of a globally connected society. It’s less about owning the right cryptocurrency or having a startup with a ridiculous valuation and more about safely exchanging the right information with each other to maintain this social fabric. It’s about recognizing one’s agency to improve quality of life and safely share the solutions with others. A web3-native approach with supportive infrastructure can help us experience the interpersonal social interactions of a small village on a global scale.

Users of DeFi applications commonly complain about high fees and costs of web3 infrastructure. That is a fair point, if the goal is to use it to create digital paintings, overly complicated online slot machines, and digital challenge coins.

But if we compare it to how much it costs to maintain ‘trusted’ third parties, accounting, transport of physical assets etc., the fees of web3 software become quite negligible.

Idealistic stories and dystopian products

The most common web3 promises paint a view of the future with less friction and more abundance in life: banking without banks, owning your data and money, funding what matters, living in network states, regenerating agriculture, and much more.

Unfortunately, these idealistic narratives are disconnected from the actual outcomes and resulting products. Online conversations in the web3 industry are very noisy, and what we see and read is usually the same web2 stuff with a different UI wrapper and fancy animations on the website.

Most people get their knowledge from centrally controlled web0 and web1 distribution networks (newspapers, radio, TV, etc.), which gives them a sense of safety and confidence.

Everyone else lives on web2 media networks (Twitter, Instagram, Linkedin) that elevate the loudest or most wealthy individuals.

This is also where the web3 community socializes.

But rather than speaking from a place of web0/web1 expertise in the topics I mentioned above, the most popular became wealthy by taking uneducated risks with their attention or money.

“Hi, my name is Alex, I bought Bitcoin in 2015.”

- real intro line of someone I met at a dinner party

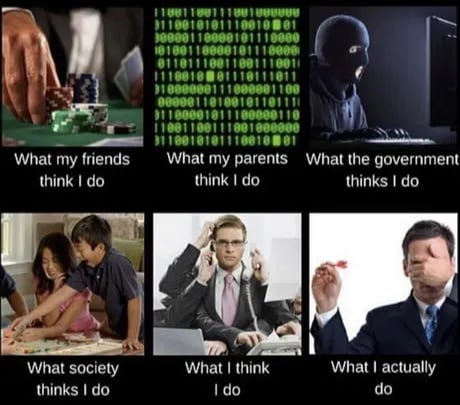

Most people who steer the flow of value in web3 don’t have the background required to build useful web3 infrastructure. They have not faced the existential challenges that web3 infrastructure can help us resolve to lead to more sustainable economies, knowledge management, or monetary sovereignty.

They can, however, explain to other founders the actions that made them wealthy while telling stories of prosperity, financial freedom, and what “web3 can do”.

So what are people in web3 actually doing?

Over-engineering and reinventing the wheel

As an unbiased collective of freelancers, we work on projects across many industries and constantly learn from each other. We give expert advice based on what works in the real world, learn about the nuances and possibilities of web3, and most importantly, recognize patterns inside the web3 ecosystem.

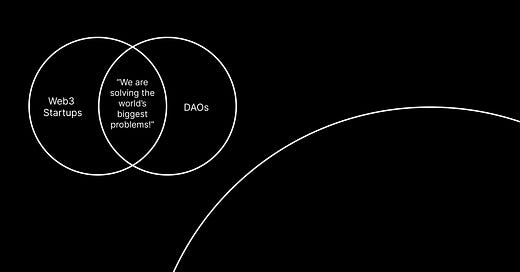

Technical startups are excited…

…about a unique technological innovation and are looking for the right problem to solve with it. In branding or website projects, we commonly see teams struggle to articulate their value proposition, so they end up spending their resources on becoming faster, cheaper, and aesthetically appealing.

The lack of management structure (perhaps a way to rebel against the establishment) keeps new ideas constantly emerging from team members but never finding alignment on actionable tasks. Flawed user research approaches keep them from realizing that they are either too early or their technology is not valuable enough to shift users from what already works. Not to mention that undercutting the competition by being faster or cheaper is a losing game in business.

DAOs try to crowdfund to innovate…

…on good causes while promising ROI. In practice, they are shared bank accounts with empty promises. Financial control relies on nepotism because there is no validation of expertise. Trusting people without knowing them personally makes it very hard to distribute money to good causes at scale, so it's mostly just spent on vibes.

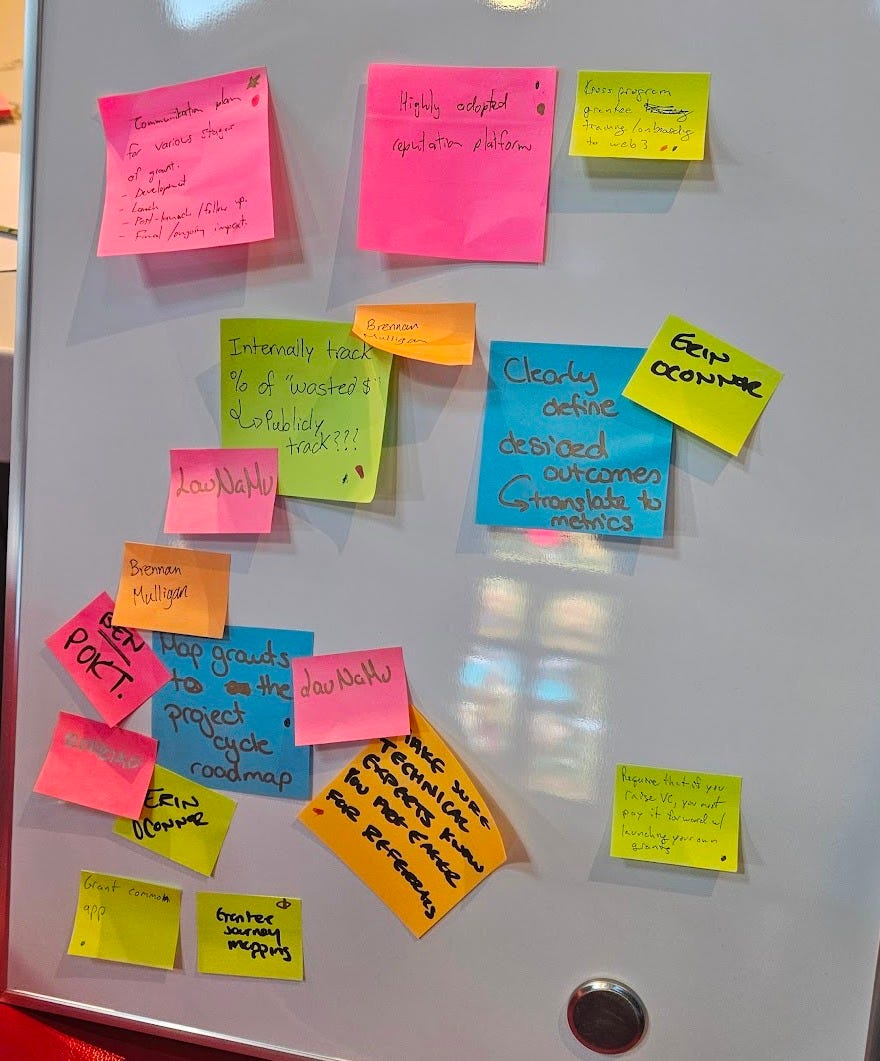

Grant programs struggle to measure impact…

The main discussion among grant programs is about the lack of impact measurement and voting power allocation at a scale. In our experience, the lack of adequate evaluation systems leads to two common outcomes:

Funding goes to projects based on a simple promise, often without evidence of the ability to execute and create value.

Well-intended and well-researched projects can easily get shut down by a token whale, overpowering the rest of the voters.

VCs make informed guesses at best…

Their limited ability to gain real insights into teams’ progress (once every 3-6 months per team) makes it difficult to track portfolio performance and support them with what they need. With a lot of design-focused projects, we see a big push on optics - visual fidelity, buzzwords, and tokenomics to attract users to portfolio companies.

Product-market fit: Digital gold, surveillance, casinos

Most projects in web3 or crypto struggle with product-market fit. Those who actually try to follow their idealistic promises get stuck or run out of funding. The funding mechanisms are designed for fast success, but good products take a long time.

Bitcoin took 16 years to find product market fit as digital gold, and required extensive expertise in financial systems and systems engineering.

Stablecoins were mostly used to provide liquidity to crypto markets and easily protect assets from volatility. Most of them rely on interest on reserves to stay sustainable. Only recently, governments are starting to adopt them in the real world, as a more efficient method to maintain the global USD hegemony and to trace individual expenses.

Uniswap and other decentralized exchanges are niche projects in the financial industry that take fees from trading to generate revenue.

There are also NFT marketplaces that tokenize digital assets to verify ownership of art, items in video games, and membership passes. I have yet to see an event that successfully uses NFT passes.

It is difficult to reach product-market fit with a usable web3 infrastructure that does not aim to enrich founders and investors at the expense of its users.

“Nobody wants to get rich slow.”

- Warren Buffet on why most people don’t follow his investment strategy.

From the list of idealistic stories, we are barely scratching the surface of financial self-sovereignty. And still, most projects are unsustainable because they rely on token incentives, VC funding, and grants.

In the next part, I will share what I learned about the incentive structure for investments and startups, which makes it very difficult to build products and infrastructure with real-world value. In the last part, I will attempt to close the circle by providing suggestions on how we can approach web3 innovation differently.